Challenge

Given customers' differing attitudes towards banks, financial security and literacy, it was vital to integrate a variety of perspectives. This was achieved through a 20 person customer panel who were hand-picked to provide live, ongoing feedback.

Extensive state-of-art research was conducted to inform online participant tasks. Findings were then enriched through a co-creation workshop and tested through 5 iterations of a digital prototype which, enabled the development of multiple user flows to validate how TSB’s products and channels supported the goal of promoting better money confidence.

Solution

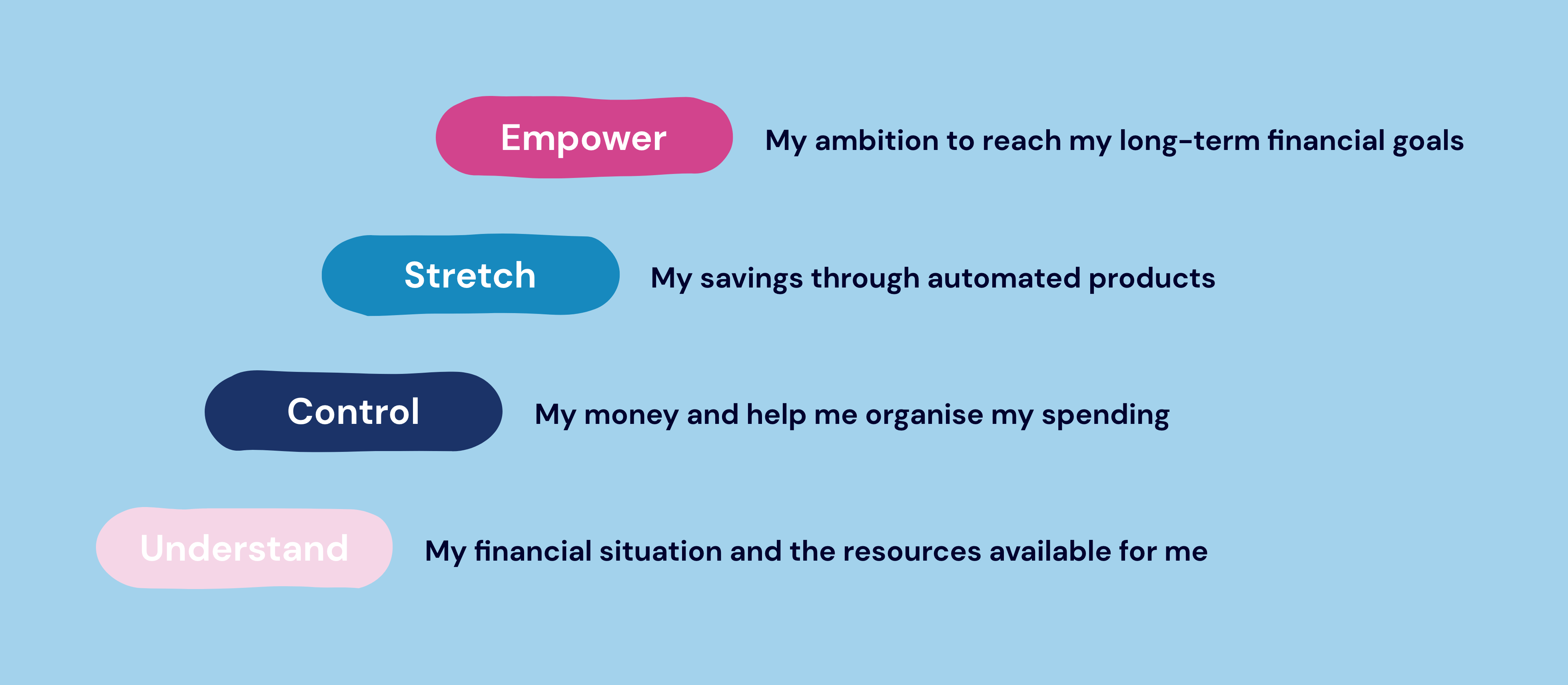

Outputs from user research were combined to form a framework, which encouraged TSB to take a step back and ask what customers would need in order to successfully build better money habits. The following steps were integrated as part of the wider Money Confidence campaign, launched in 2021:

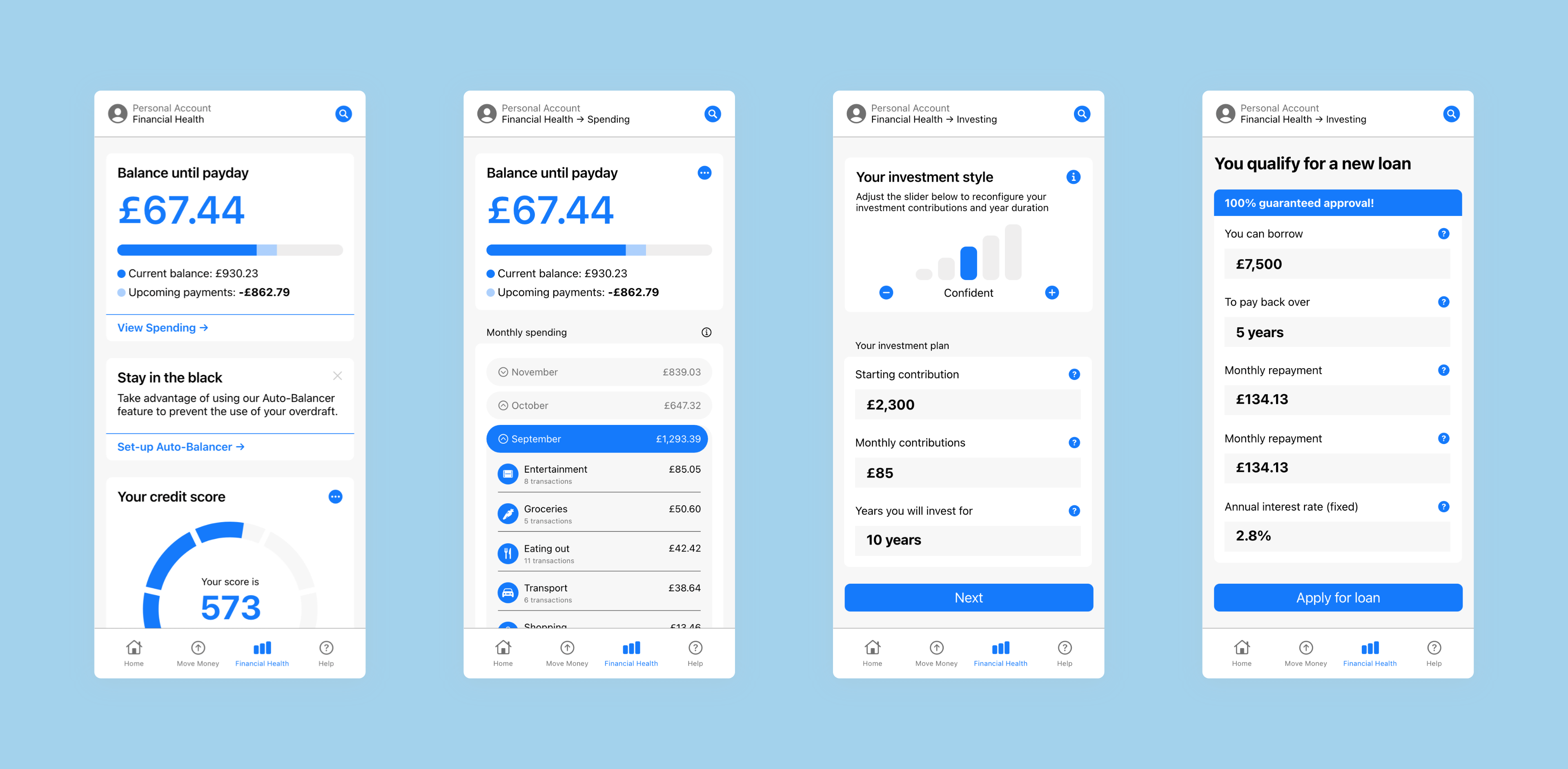

Understand: The first step focuses on listening to the customer and promoting resources which speak to their financial situation based on their life context. Understanding should not be used as a sales exercise, but showing the final goals and steps that the customer could take, communicated without the use of jargon.

Control: Having built an understanding of the customer and their financial context, the following step supports customers keep on top of it. Control means that customers should be able to know where their money is and be aware of the steps they should take to avoid any problems – enabling them to build confidence.

Stretch: Once customers feel comfortable, they seek to be guided through ways to make their money go further. This means utilising digital tools to automate actions without the customer having to do anything differently.

Empower: Only after these previous steps have been achieved will customers then look to develop better money habits. This can be achieved through the use of structured nudges, presenting products that will support customers to reach their long term financial goals.